Remember the allowance? We were always two sides. Some of us used to go with the cheque at the end of the month so that we could take out the money for a whole year—others used to do it monthly. Okay, the decision wasn’t really ours, it was of our parents. But anyway, we took it out,we were not saving anything,we weren’t investing.

Mihai Constantinescu tells us that we can do much more with the allowance of our children. Even DOUBLE it. It sounds like science fiction ,no? And it’s not even complicated! Explains all below the ATLAS Financial Education Specialist how to do this.

I told in a previous article about financial education and how this area can help us, and I said that “Financial education is about money and how to manage to do more with this money…”. At the same time, in this article I also said that “Financial education can help in the early financial preparation of children’s education”, and today’s theme aims to combine the two aspects.

How can you DOUBLE the amounts that your children collect throughout their childhood or adolescent lives?

If we discuss the current situation, every child in Romania receives, depending on their age, a state allowance.

The amount of this allowance shall be as follows:

- for children aged 0 to 2 years, the monthly allowance is RON 300 (from 1 January 2020 the allowance is indexed to inflation and its value is RON 312);

- for children between 2 and 18 years of age, the monthly allowance is RON 150 (from 1 January 2020, the allowance is indexed to inflation and its value is RON 156).

The total amount, if the amount of allowances is kept at this level (although there is a decision by Parliament to double the amount of these allowances in the near future) during the 18 years, is RON 37,440. In general, the fate of this money is either spending them or saving them in a current account or a bank deposit, variants that often do not even cover inflation. Unfortunately, most parents do not know that there are many ways to place these amounts of money so that the returns are significantly higher than those offered on deposits and besides the investment risk if done in the long term, is lower.

Case study

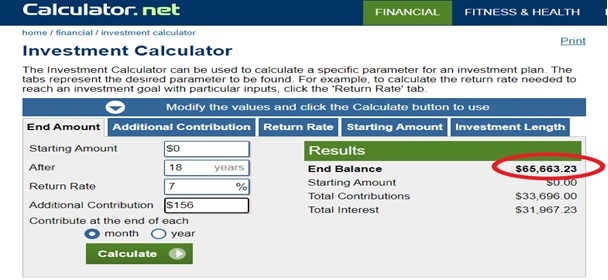

Next let’s see what the final amount we could reach if we place 156 RON monthly (representing the current level of the allowance), with an average return of 7%/year, over a period of 18 years, assuming that from the first month since the child was born, all the amounts received by the child through the allowance are invested:

Next let’s see what the final amount we could reach if we place 156 RON monthly (representing the current level of the allowance), with an average return of 7%/year, over a period of 18 years, assuming that from the first month since the child was born, all the amounts received by the child through the allowance are invested:

The total amount, which you can obtain, under the conditions of regular investment of these amounts of money, the retention of the investment for the period of 18 years and assuming an average return of 7% is RON 65,623 (i.e. an amount almost double that invested of RON 33,696).

In what way can we place the amounts received from allowances?

In addition to placing money in bank deposits, there is a multitude of tools in which you can place money:

- Investment funds;

- Government securities;

- Government savings programs for children;

- Shares/stocks;

- Bonds;

Is it possible to achieve an average return of 7% per year for a diversified, long-term investment?

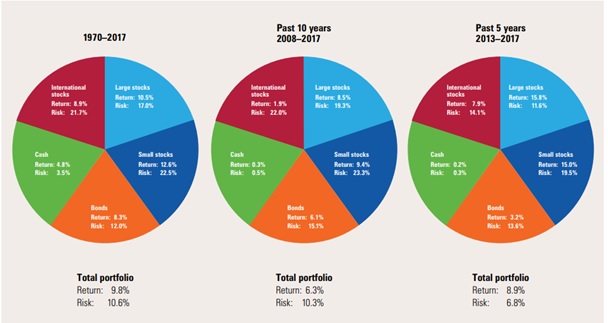

To answer this question, you can still find historical yields, in USD, considering a diversified portfolio with the following structure:

- 20% cash;

- 20% U.S. bonds;

- 20% shares in large U.S. companies;

- 20% shares in Small and Medium-sized Companies;

- 20% international shares.

What you can see is that this portfolio brought an average return per year, between 6.3% and 9.8%, depending on the investment period, making the return of 7% more than achievable.

You probably think that in Romania you can not get such yields. Nothing more fake. The average return on the 7 Pillar II pension funds, which contain diversified portfolios, with the majority of investments made in Romania was 8.35% / year, taking into account the period from May 2008 and until December 2019.

At the same time, if we discuss the monthly investment in Romanian shares (in the BET index), for a period of 16 years (2000 – 2015), this investment brought a return of 19% / year.

What can your 18-year-old do with this amount?

- He can pay for part or all of his studies abroad;

- Can give the advance for his own home;

- He can start a business;

- Or why don’t you- can travel around the world.

Today’s article is not about the 7% return, but about how financial education can help us achieve important financial objectives more easily.

It should be noted that investments also involve risks, so before making an investment of any kind you must also inform yourself about the risks.

Think about how much these amounts can reach at the end of the period if the allowances are doubled (as they discuss ) or if, in addition to the amounts collected from the allowances, you put the same amount each month.

Let’s set up a financial coaching session and talk about how you can do more with the same money.